Is Mansa X legit? Mansa X Fund Comprehensive Reviews 2025

Is Mansa X legit? Mansa X Special Fund is indeed legitimate and fully regulated. The fund is managed by Standard Investment Bank (SIB), a well-established financial services firm founded in 1995 with over KES 750 million in shareholders’ funds. Most importantly, Standard Investment Bank was licensed by the Capital Markets Authority (CMA) in August 2024 to operate Special Collective Investment Schemes (CISs), making Mansa X the first fund to receive this special designation in Kenya.

Table of Contents

The Capital Markets Authority is Kenya’s primary financial markets regulator, established in 1989 to ensure orderly, fair, and efficient capital markets. This regulatory oversight provides investor protection and ensures that Mansa X operates within established legal frameworks. The fund is also regulated as a special collective investment scheme under the Capital Markets (Collective Investment Schemes) Regulations, 2023.

Fund Performance Since Inception

Annual Returns Performance

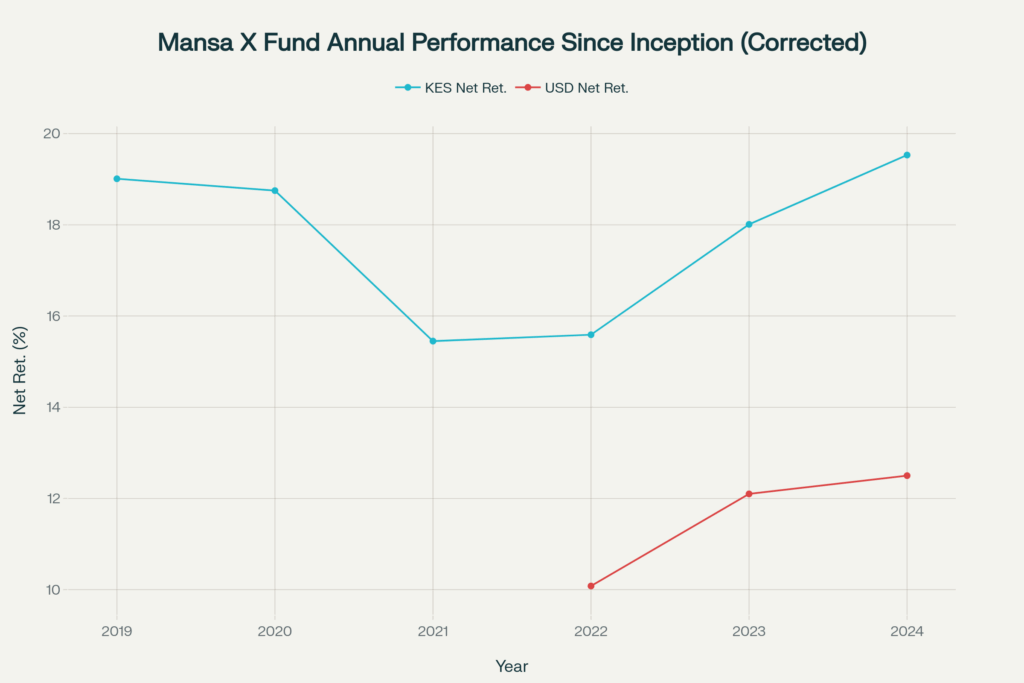

Mansa X has demonstrated consistent performance since its launch in January 2019. The KES-denominated fund has delivered impressive annual net returns, while the USD fund (launched in October 2022) has also shown strong performance.

Mansa X Fund annual performance comparison between KES and USD denominated funds from 2019-2024

Key Performance Highlights

| Year | KES Fund Net Return (%) | USD Fund Net Return (%) |

|---|---|---|

| 2019 | 19.01% | – |

| 2020 | 18.75% | – |

| 2021 | 15.45% | – |

| 2022 | 15.59% | 10.08% |

| 2023 | 18.01% | 12.10% |

| 2024 | 19.53% | 12.50% |

USD Fund started in October 2022, showing annualized return

2025 Quarterly Performance

The fund has continued its strong performance into 2025:

- Q1 2025: KES Fund delivered 4.89% (19.56% annualized), USD Fund delivered 3.14% (12.56% annualized)

- Q2 2025: KES Fund delivered 6.05% (best quarterly return since inception), USD Fund delivered 3.47%

The average annual net return since inception is 17.72% for the KES fund and 12.27% for the USD fund. A hypothetical KES 1,000,000 investment made at inception would have grown to KES 3,118,554.06 by June 2025.

Top 10 Holdings Analysis

Mansa X maintains a diversified portfolio across multiple asset classes and geographies. The fund’s top holdings as of Q2 2025 demonstrate this diversification strategy:

The fund’s holdings reflect its multi-asset approach, with significant allocations to:

- Fixed Income Instruments (largest holding at ~13%)

- Interest Rate Derivatives (~5%)

- Commodities (WTI Crude Oil, Gold/Silver Futures)

- Technology Stocks (Netflix, Oracle, NVIDIA, Microsoft, Meta)

- Cash and Cash Equivalents for liquidity management

Geographically, the funds are well-diversified with the KES fund having 45.39% in Americas, 31.27% in Europe, 16.45% in Africa, and smaller allocations to Asia and Oceania.

Investment Requirements and Process

Minimum Investment Amounts

| Fund Type | Minimum Investment | Minimum Top-up |

|---|---|---|

| KES Fund | KES 250,000 | KES 100,000 |

| USD Fund | USD 2,500 | USD 1,000 |

Fee Structure

- Initial Fee: 0%

- Redemption Fee: 0%

- Management Fee: 5% per annum (pro-rated daily)

- Performance Fee: 10% on returns above hurdle rate

- KES Fund: 25% hurdle rate

- USD Fund: 15% hurdle rate

- Lock-in Period: 6 months minimum

How to Invest in Mansa X

- Account Opening: Contact Standard Investment Bank via email (clientservices@sib.co.ke) or phone (+254 777 333 000)

- Documentation: Provide valid ID, KRA PIN, utility bill, bank statement, and passport-size photograph

- Initial Deposit: Transfer minimum investment amount via bank transfer or mobile money

- Account Activation: Typically takes 3-5 business days from document submission

Is Mansa X a Good Investment?

Based on performance metrics and regulatory status, Mansa X presents several compelling features:

Strengths:

- Consistent above-market returns (17.72% average for KES fund)

- Regulated by Capital Markets Authority

- Diversified global exposure across 200+ asset classes

- Long/short trading model helps protect against market volatility

- No initial or redemption fees

Considerations:

- Higher minimum investment (KES 250,000) may limit accessibility

- 6-month lock-in period reduces liquidity

- Performance fees apply above hurdle rates

- Higher risk profile compared to traditional money market funds

What is the Yield of Mansa X?

The fund doesn’t offer a fixed yield but has historically delivered:

- KES Fund: Average 17.72% annual net return since inception

- USD Fund: Average 12.27% annual net return since inception

- 2024 Performance: 19.53% (KES), 10.08% (USD)

Mansa X Money Market Fund Interest Rate

It’s important to clarify that Mansa X is not a money market fund. It’s classified as a “Special Collective Investment Scheme” that invests in multiple asset classes globally. Unlike money market funds that invest in low-risk, short-term instruments, Mansa X employs a multi-asset strategy with higher return potential but also higher risk.

Assets Under Management Growth

The fund has experienced remarkable growth, with total assets under management reaching:

- KES Fund: KES 47.05 billion as of December 2024

- USD Fund: USD 78.88 million as of June 2025

- Total Combined AUM: Over KES 65 billion as of Q2 2025

This growth has generated significant fee income for Standard Investment Bank, with management fees increasing to KES 1.4 billion in 2024, up 68.4% from KES 874.4 million in 2023.

Risk Assessment and Investor Suitability

Mansa X is rated as a medium to high-risk investment due to its exposure to global markets, derivatives, and volatile asset classes. The fund may be suitable for:

- Investors seeking above-average returns

- Those comfortable with higher risk profiles

- Investors wanting global market exposure

- Those with investment horizons exceeding 6 months

The fund may not be suitable for:

- Risk-averse investors

- Those needing immediate liquidity

- Investors unable to meet minimum investment requirements

- Those seeking guaranteed returns

Conclusion

Mansa X Special Fund is legitimate, well-regulated, and has demonstrated strong historical performance. With consistent returns averaging over 17% annually for the KES fund and proper regulatory oversight by the Capital Markets Authority, it represents a credible investment option for qualifying investors seeking diversified global exposure and above-market returns.

However, potential investors should carefully consider the higher risk profile, minimum investment requirements, and lock-in period before investing. As with any investment, past performance does not guarantee future results, and investors should assess their risk tolerance and investment objectives before committing funds.

What is the Return of Mansa X in 2025?

In the first half of 2025, Mansa X has delivered exceptional performance:

H1 2025: KES Fund returned 10.94% (21.88% annualized), USD Fund returned 6.61% (13.22% annualized)

Q2 2025 marked the best quarterly performance in the fund’s history for the KES denomination

What is the Minimum Investment for Mansa X?

KES Fund: KES 250,000 minimum investment, KES 100,000 minimum top-up

USD Fund: USD 2,500 minimum investment, USD 1,000 minimum top-up